Indonesia’s payroll system demands precision, regulatory discipline, and speed. Yet if you are a foreign investor or business owner expanding into Southeast Asia’s largest economy, chances are you will run into common payroll errors sooner than expected.

These mistakes don’t just trigger fines. They erode employee trust, invite regulatory scrutiny, and quietly weaken your operational credibility.

This guide walks you through the most common payroll errors in Indonesia, why they happen, and—more importantly—how you can fix them before payroll turns from a compliance task into a recurring risk.

Why Common Payroll Errors Matter More in Indonesia Than You Think

Payroll compliance in Indonesia sits at the intersection of three tightly regulated systems: progressive income tax (PPh 21), mandatory social security contributions (BPJS Kesehatan and BPJS Ketenagakerjaan), and labor rules governing overtime, leave, attendance, and minimum wages.

You’re expected to withhold PPh 21 monthly using average effective rates (TER), calculate and remit BPJS contributions on strict deadlines, apply the correct regional minimum wage (UMK/UMP), and maintain audit-ready records. Miss just one element, and the entire payroll cycle becomes exposed to compliance risk.

For foreign-owned companies, the risk multiplies. Labor inspections tend to be stricter, employee complaints are more frequent, and compliance failures can quickly attract public and media attention. At the same time, many multinational parent companies now treat labor compliance as part of ESG accountability—turning payroll accuracy into a governance issue, not just an HR task.

The consequences are real: penalties, retroactive payments, reputational damage, and operational disruption. The upside? Common payroll errors in Indonesia are rarely random. Most payroll compliance issues follow predictable patterns. If you identify them early and fix them systematically, you can prevent costly errors long before they escalate.

Also read: Job Posting Compliance for Hiring in Indonesia

1. Incorrect Payroll Tax Withholding

PPh 21 is one of the most technically demanding parts of Indonesian payroll—and one of the easiest to get wrong at scale. The calculation depends on multiple variables: income level, PTKP (marital status, dependents), NPWP status, and whether income is properly annualized. The rules are clear, but payroll tax errors happen when your data doesn’t move as fast as your people do.

What goes wrong? You forget to apply the 20% higher rate for employees without NPWP. PTKP isn’t updated after marriage or a new dependent. A mid-year promotion isn’t annualized correctly, distorting withholding for months.

Even when the math is right, missing the payment deadline (15th) or reporting deadline (20th) still triggers penalties. By year-end, reconciliation reveals the uncomfortable truth: the issue wasn’t a one-time mistake—it was baked into the process.

These errors hit from multiple angles. Employees question their take-home pay. Corporate tax exposure becomes unclear. And for foreign-owned companies under closer scrutiny, payroll accuracy starts to look like a governance issue.

How to fix it

Clean data comes first. Each employee should have one verified tax profile, complete with effective dates for any change. Use a rules-based payroll system with built-in PPh 21 logic that stays current with tax brackets and PTKP values. Automate income annualization for mid-year changes and run monthly variance checks. Sudden, unexplained swings in PPh 21 are early warning signs—if you catch them early, you avoid year-end damage.

Also read: Income Tax in Indonesia for Foreign Businesses

2. Late or Miscalculated BPJS Contributions

Employers must contribute to BPJS Kesehatan and BPJS Ketenagakerjaan, each with its own deadline and calculation rules. How does the mistake start? Delays and underpayments remain some of the most common payroll errors.

The pattern is familiar. Salary gets paid on time, BPJS is pushed “to next week.” New hires start working but aren’t enrolled immediately. Salary increases update payroll but not BPJS contribution bases.

Incorrect rates or caps create discrepancies between payslips and actual remittances. Over time, penalties accumulate—and employees only realize there’s a problem when healthcare access fails.

BPJS payroll compliance lapses don’t just trigger fines. They erode employee trust and expose weak internal controls—red flags for foreign-owned companies already under the microscope.

How to correct it

BPJS should be fully automated within your payroll system, with correct employer–employee splits applied by default. HR and payroll data must sync in real time so hiring, termination, and salary changes immediately update contribution bases. Set internal cutoffs days before statutory deadlines and maintain clean enrollment and monthly contribution reports. When audits happen, this documentation matters.

Also read: Indonesia Labor Law: Key Rules for Foreign Business

3. Underpaying Overtime

Overtime calculation in Indonesia is one of the most heavily scrutinized payroll areas—and one of the most misunderstood. Regulations require 1.5× the hourly wage for the first overtime hour and 2× for subsequent hours. Yet many companies still rely on flat “overtime allowances” that have little connection to actual hours worked.

This usually starts as a convenience. You pay a fixed amount instead of tracking hours properly. Monthly-paid employees get miscalculated hourly rates. Without reliable attendance data, payroll can’t defend its numbers. When employees file complaints or inspectors compare attendance records with payroll, inconsistencies surface fast.

Underpaying overtime rarely stays a payroll issue. It often leads to retroactive wage claims, collective disputes, and broader labor inspections.

How to get it back on track

Implement digital attendance and overtime tracking integrated directly with payroll. Configure statutory overtime formulas so 1.5× and 2× multipliers apply automatically to verified hours. Require written or digital overtime approval before work begins and reconcile approvals against actual attendance. For monthly-paid employees, ensure compliant hourly rate calculations and automatic flags for underpayment.

Also read: Understanding Indonesia Overtime Rate and Law

4. Applying the Wrong Regional Minimum Wage

Indonesia doesn’t have one minimum wage—it has many. Provincial (UMP) and city or regency (UMK) rates change annually, usually effective in January.

Where do companies make minimum wage payroll errors? Businesses with multiple locations still apply a single wage floor or miss updates entirely.

You assume one “national” rate is enough. Payroll misses annual adjustments. Allowances don’t move when minimum wages rise. UMK/UMP violations are easy to verify and difficult to justify.

How to stay compliant

Map employees accurately by work location in your HRIS, especially for field and hybrid roles. Maintain location-specific wage tables with clear effective dates. Configure payroll to validate salaries against the applicable UMK/UMP before processing. Document every update—rate changes, affected employees, and adjustments—so you’re never explaining decisions from memory.

Also read: Requirements for Foreign Workers in Indonesia

5. Mismanaging Leave and Annual Leave Allocation

Leave issues rarely look serious—until payroll breaks. Indonesian Labor Law guarantees 12 days of annual leave, plus public and religious holidays. When leave data is scattered or inconsistently approved, payroll accuracy collapses fast.

Where do things break? You don’t track leave centrally. Managers approve requests in chats or email. Public holidays are worked but never flagged. Payroll receives partial data and recalculates balances manually. By payday, no one agrees on how much leave was taken—or owed.

These leave and attendance errors lead to underpaid holidays, disputed balances, and zero audit trail when employees push back.

The corrective approach

Centralize leave in an employee leave and absence management system. One request flow, one balance, one source of truth. Link attendance directly to payroll so public-holiday work and approved leave adjust pay automatically. Document your leave policy clearly and publish it to employees—clarity prevents conflict before it starts.

6. THR and Bonus Miscalculation

Religious holiday allowance (THR) is mandatory. Bonuses are sensitive. Get either wrong, and payroll disputes escalate quickly—especially around mid-year hires and resignations.

What gets overlooked? You pro-rate THR inconsistently. Resigning employees dispute entitlement. Bonuses rely on outdated salary data or manual spreadsheets. No one can clearly explain who qualifies—or why.

These THR and bonus calculation errors inflate costs, delay payouts, and damage trust.

What effective companies do differently

Standardize and document THR and bonus rules once—then stop calculating them manually.

Embed the rules into your payroll system so proration, eligibility, and resignations are handled automatically. Communicate policies upfront and publish them in your employee handbook to eliminate ambiguity.

Also read: How to Calculate Bonus Tax with New Rates

7. Poor Record-Keeping and Missing Audit Trails

Payroll compliance isn’t just about paying correctly—it’s about proving it. Indonesian regulations require employers to retain years of payroll, tax, BPJS, and attendance records. Yet many companies still scatter this data across spreadsheets, inboxes, and paper folders.

When inspectors ask questions, you scramble. Payslips can’t be traced. Historical PPh 21 data can’t be reconstructed. Changes have no clear explanation. What should be routine turns into weeks of damage control.

What needs to change

Centralize payroll and HR data in a cloud-based HRIS with built-in audit logs. Generate and archive digital payslips automatically. Run quarterly internal payroll reviews to confirm both calculations and documentation. Keep an audit-ready repository so inspections don’t disrupt operations.

8. Missing Payroll and Statutory Reporting Deadlines

Indonesia’s payroll timelines leave little room for error. Salaries follow fixed schedules. PPh 21 and BPJS deadlines are strict. Miss one, and penalties follow.

Most delays aren’t caused by complexity—they’re caused by weak coordination. Approvals stall. Reconciliation drags. No one clearly owns the deadline. Without automation, HR and Finance only realize something is due when it’s already late.

How to close the gap

Set internal cutoffs 3–5 days before statutory deadlines. Use payroll systems with automated reminders visible to HR, Finance, and leadership. Eliminate manual handoffs and assign clear ownership for each deadline. On-time compliance should be intentional, not accidental.

9. Relying on Manual Spreadsheets as You Scale

Spreadsheets work—until your company grows. Once headcount passes 30, 50, or 100, Excel stops being efficient and starts multiplying risk.

One broken formula affects everyone. Multiple versions circulate. Access control disappears. Audit trails vanish. When regulators ask why a number changed, you have no defensible answer.

How to prevent it from escalating

Move payroll out of files and into a cloud-based system built for Indonesia’s regulatory complexity. A proper payroll platform handles PPh 21, BPJS, overtime, leave, and UMK/UMP with built-in logic and audit logs. Train HR and Finance properly, integrate payroll with attendance and HR data, and enforce one rule: payroll lives in the system—not in Excel.

Also read: Recruitment of Foreign Workers Regulation Indonesia: A Complete Guide

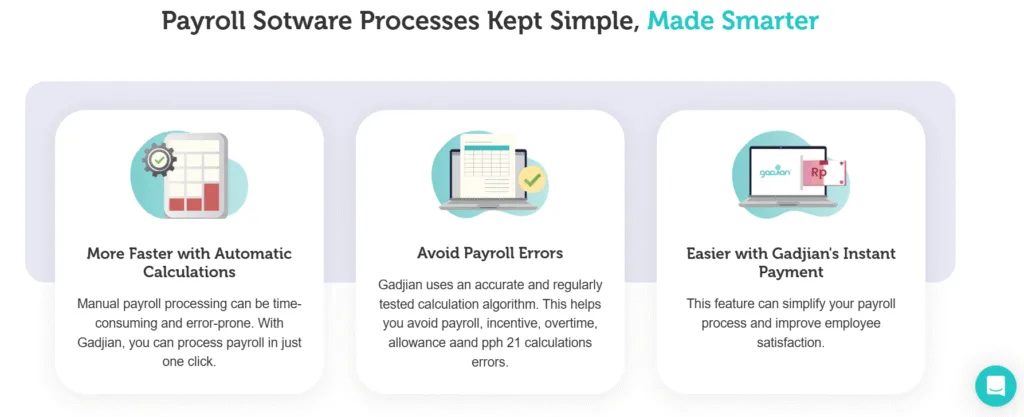

How Gadjian Solves Common Payroll Errors at Scale

Gadjian is a cloud-based HRIS built specifically for Indonesian payroll. It brings salary calculations, tax, BPJS, overtime, leave, and attendance into one integrated platform—automating the mechanics behind most common payroll errors while generating audit trails regulators expect.

Autopilot Payroll with Accurate Calculations

Gadjian runs monthly payroll in a single action using a continuously tested calculation engine. Salaries, allowances, bonuses, deductions, and statutory overtime calculation are processed automatically based on verified attendance data with no manual recaps required.

- Process payroll for all employees at once with instant results

- Automatic daily wage calculation—prorated salaries for new hires, resignations, and irregular attendance

- Built-in overtime automation aligned with Indonesian Labor Law

- Configure THR allowance and performance or annual bonuses based on company policy

- Centralized management of cash advances and salary deductions to prevent disputes

Accurate PPh 21/26 and Tax Reporting

Gadjian’s all-in-one payroll tax module calculates PPh 21 and PPh 26 accurately, supports retroactive corrections, and generates filing-ready outputs. Digital withholding certificates are issued automatically for each employee.

- Automatic application of current PPh 21 brackets, PTKP values, and NPWP surcharges

- Tax correction capability without rebuilding spreadsheets

- Ready-to-file outputs—CSV exports and tax reports prepared for government submission

- Automated withholding certificate generation for employees and compliance records

Integrated BPJS Kesehatan and BPJS Ketenagakerjaan

Gadjian automates BPJS payroll compliance for both Kesehatan and Ketenagakerjaan, embedding contributions directly into payslips with full transparency. Contribution rates stay current as regulations evolve.

- Automated BPJS calculations by splitting employer–employee contribution

- Contribution rates adjust automatically when regulations change

- Clear visibility of BPJS deductions in payslips

- Structured BPJS data ready for reconciliation and submission

Attendance, Shift, and Leave Integration

Gadjian connects directly to attendance devices and mobile apps, pulling time data straight into payroll. This removes manual recaps and ensures leave and attendance errors never reach salary calculations.

- Attendance data flows directly into payroll

- Lateness calculation for deduction

- Digital shift management allows employees to view schedules

- Approved leave updates balances and payroll instantly

- Multi-level leave approval flow seamlessly

Employee Self-Service via GadjianKu Mobile App

The GadjianKu mobile app gives employees real-time access to payroll, attendance, and leave data—reducing disputes and improving trust through transparency.

- Download PDF payslips and view historical salary data

- Visibility into attendance report

- Submit leave, permission, and sick requests with approval workflows

- Team engagement by automated birthday and recovery messages

- Employees update personal information with HR validation

Centralized Record-Keeping and Audit Readiness

Gadjian consolidates contracts, salary history, tax records, BPJS contributions, and attendance into a secure cloud system—replacing spreadsheet chaos with audit-ready documentation.

- Unified HRIS database—one secure source for all employee and payroll data

- Searchable digital payslips stored automatically by period and employee

- Full visibility into who accessed or changed data and when

- On-demand payroll audit reports with calculation breakdowns

Payroll accuracy in Indonesia isn’t just about getting numbers right—it’s about proving that your business is compliant, credible, and ready to scale. When payroll runs clean, on time, and audit-ready, regulators stay quiet, employees stay confident, and leadership stays focused on growth.

By systematizing payroll with an integrated platform like Gadjian, you eliminate avoidable errors, reduce compliance exposure, and turn payroll from a monthly liability into a long-term operational advantage.