A foreign company should familiarize itself with labor law, business regulations and employment law in Indonesia. Comprehensive understanding of existing HR regulations is important as any non-compliance will lead to problems with authorities that can in turn cause termination of the company’s business in Indonesia. Moving forward, license to establish a company in Indonesia will also no longer be granted. The question is, “what are the crucial regulations to know as an employee?”

As an employer, there are crucial regulations to know, such as overtime regulations, all types of leaves, religious holiday allowance, basic salary calculations, income tax (PPh 21), working hours, social security, employee status, wage payment obligations and severance payments. Here are 10 business guides to HR regulations in Indonesia:

What are the regulations for overtime work?

Employers are obliged to pay overtime fees if the employees are required to work over the time limit specified by HR regulations. The overtime can only be performed if there’s an agreement between both parties; employer and employee. The maximum time of overtime work is three hours a day, or 14 hours a week, not including the overtime during public holidays or weekends.

The calculations for overtime fee are as follows:

|

Hours in a Day | Workweek | Weekend & Public Holidays | |

| 5-Days Workweek |

6-Days Workweek | ||

|

1st hour | 1,5x | – | – |

|

1st 5-hour | – | – | 2x |

|

1st 8-hour | – | 2x | – |

| Each hour later | 2x | 3x |

3x |

| 7th & 8th hour | – | – |

4x |

| 10th & 11th hour | – | 4x |

– |

*The number listed represent the regulated multiplications of normal hourly fee to be paid as overtime fee.

What are the types of leaves?

Employees have 12 working days as paid holiday after one year of service in a company. These can be taken 12 days consecutively, or separately within a year. Other leaves include:

- Marriage leave; three days for the employees’ marriage, two days for their children’s marriage.

- Female employees are entitled to have one to two days leave during the first days of their menstruation cycle.

- Muslim employees have up to three months as paid leave to perform Haj pilgrimage. This can only be taken once.

- Maternity leave; female employees have three months of paid leave when expecting. Half of the three months should be taken prior to the due date, and the other half after. This leave can be extended based on advice from licensed obstetrician or midwife.

- Other leave; employees are also entitled to have two days of leave for their children’s circumcision.

Also Read: A Complete Guide to Calculate Overtime Pay in Indonesia

What to do regarding religious holidays?

For one religious celebration each year, according to employee’s religion, employer is obliged to pay religious holiday allowance. The amount of the allowance should be calculated based on the length of service. Employee should have done at least one year of service to receive an amount of allowance equal to one month’s salary.

How to best determine an employee’s salary?

When calculating scale and structure of salary, employers should consider type, position, length of service, education and competency of their employee. It is also necessary to adjust the payment regularly in accordance to company’s financial ability and employee’s productivity. If the salary component consists of basic salary and fixed allowance, the amount of minimal basic salary is 75% of the total of basic salary and fixed allowance.

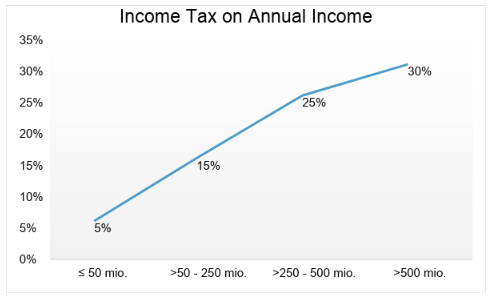

What are the regulations for income tax?

All income earned by employees in Indonesia is subject to income tax. The rates depend on annual income of the taxpayers:

For many individuals, their tax is collected by the employers through withholding. This way, employers will withhold income tax monthly from the paid salaries to employees.

For companies performing any non-compliance to tax regulations, the sanctions may vary from receiving reprimand letters to termination of the business.

How long employees can be expected to work?

Regarding work hour, all employees must only spend 40 hours on working in a week. For six work days, it is divided into seven hours per day. For five work days, it is eight hours per day.

How to help ensure employees’ security?

Another point that’s important for employers to know is social security. It is the employers’ obligation to enlist their employees in social security program managed by BPJS in Indonesia.

What are the different work agreements available in Indonesia?

The status of an employee is listed based on different expiration period of their employment agreements consisting of contract, full-time and freelance.

Also Read: A Startup’s Guide to Payroll Outsourcing in Indonesia

What is the policy for wage payment relating to performance?

When it comes to obligation of work payment, salary could not be paid when employees do not do the responsibilities relating to the work they are hired for. However, fixed wages should be paid if:

- Employees are sick and cannot work properly.

- Women on first and second day of menstrual period and cannot work.

- Family matters such as marriage, childbirth or miscarriage, death of family member, and any religious celebration held by the family.

- Employees cannot work due to obligations towards the state.

- Employees cannot work due to religious obligations.

- Mistakes conducted by the employers as in failing to employ the employees despite their willing to do the work.

- Employees carrying out the right to rest.

- Employees carrying out duties of labor unions.

- Employees carrying out educational tasks from the company.

What are the rights of terminated employees?

Furthermore, employers are also obliged to pay severance pay as well as long service pay and compensation of rights to terminated employee as stated in Labor Law No. 13 of 2003.

Try Indonesia #1 Payroll Outsourcing Service

How can payroll services be of benefit is all this?

Utilizing payroll service becomes crucial as HR regulation in Indonesia should be complied with properly. Inability to obey these rules and regulations will cause in the termination of business. Thus, to save more time and to work more efficiently employers need a payroll service that is able to help them run the business smoothly. Payroll outsourcing eliminates the need to calculate basic salary, income tax, working hours and other obligations that are usually performed by HR departments.

Is there any recommended payroll service software in Indonesia?

In this particular case, Gadjian will work efficiently for the business. This online HR software is able to handle every detail pertaining to the employees. Every month Gadjian will calculate the payment and salary as well as allowance added and reduced by components agreed beforehand. Employees will receive a slip of payment containing these details. Companies save time while also eliminating the risk of miscalculations. What would be better than to sign up for Gadjian now?