Indonesia’s pool of foreign talent is expanding fast. Under the recruitment of foreign workers regulation Indonesia, this growth is no longer anecdotal — it is measurable and accelerating. According to Ministry of Manpower, Indonesia employed 184,000 foreign workers by the end of 2024, an 8.9% increase from 168,000 in 2023, extending three consecutive years of growth despite global economic uncertainty.

This surge reflects Indonesia’s rising position as a regional investment hub. China dominates the workforce, followed by Japan, South Korea, India, and Malaysia, while talent from Australia, the US, the UK, and the EU increasingly fills high-skill gaps in technology, manufacturing, energy, and professional services.

Behind these numbers, however, sits a regulatory framework many employers still misread. The recruitment of foreign workers regulation Indonesia is not a simple hiring requirement. It governs who you can hire, which roles they may occupy, how long they can work, and what compliance obligations you must meet.

Understanding this framework before hiring is what separates smooth expatriate deployment from costly delays, permit revisions, and avoidable operational risk.

How Indonesia Regulates Foreign Worker Employment

The recruitment of foreign workers regulation Indonesia is not a single statute, but a layered foreign employment compliance framework that governs who you can hire, for what role, under which conditions, and with what ongoing obligations. Its core objective is clear: allow foreign expertise while safeguarding local workforce development and structured knowledge transfer.

Government Regulation No. 34/2021 anchors this framework, Presidential Regulation No. 20/2018 refines it, and Minister of Manpower Regulation No. 8/2021 implements it. Together, these rules form Indonesia’s foreign worker employment compliance regime, covering approval, utilization, reporting, and enforcement.

Hiring under this system is not an immigration formality. Employers must justify the role, submit a foreign manpower utilization plan, appoint Indonesian counterparts, and maintain continuous compliance. In short, the regulation allows foreign professionals only when they add strategic value, not when they replace local talent.

Also read: Indonesia Labor Law: Key Rules for Foreign Business

Who Can Employ Foreign Workers in Indonesia?

As governed by the recruitment of foreign workers regulation Indonesia, only certain entities are eligible to hire expatriates. Legal presence, proper licensing, and localization capacity are non-negotiable.

In practice, this includes PT companies — particularly PT PMA, registered representative offices, and specific government or international organizations. For most foreign investors, establishing a PT PMA is a prerequisite before any foreign employment approval.

Even then, compliance scrutiny remains strict. The government expect employers to prioritize Indonesian workers, meet localization benchmarks, and demonstrate that expatriate roles address genuine skill gaps. Sector growth may attract foreign talent — but it does not dilute regulatory control.

Allowed Sectors and Job Positions

Indonesia does not adopt an open-ended approach to foreign employment. Under the recruitment of foreign workers regulation Indonesia, Minister of Manpower Decree No. 228/2019 strictly governs eligibility by defining which sectors and job positions foreign workers may legally fill.

This regulation functions as the central compliance reference within Indonesia’s foreign worker employment compliance regime. In practice, it serves as a legal gatekeeper: roles not explicitly listed will not receive RPTKA approval.

The 18 Approved Sectors

Minister of Manpower Decree No. 228/2019 limits foreign worker employment to the following 18 eligible industry sectors, subject to role-specific approval and successful RPTKA validation:

- Construction

- Real estate

- Education

- Manufacturing

- Water management, wastewater management, waste and recycling, and remediation activities

- Transportation and warehousing

- Arts, entertainment, and recreation

- Accommodation and food & beverages

- Agriculture, forestry, and fishery

- Renting activities, employment services, travel agents, and other business support

- Financial services and insurance

- Public health activities and social services

- Information and telecommunications

- Mining and excavation

- Electricity, gas, steam/hot water, and cool air procurement

- Wholesale and retail trading, automotive service, and maintenance

- Other services

- Professional, scientific, and technical activities

Approved Job Positions for Foreign Workers

Within these sectors, Indonesia permits foreign workers to occupy managerial, technical, and advisory roles that are strategic or highly specialized. Commonly approved positions include General Manager, IT Manager or Advisor, Engineering Managers and Technical Advisors, Sales and Marketing Managers, Production and Logistics Advisors, Financial Advisors, and Research or Corporate Planning Managers.

Beyond these examples, the 138-page annex to Minister of Manpower Decree No. 228/2019 provides detailed job references, complete with ISCO and KBJI codes. During RPTKA assessment and post-approval audits, authorities expect employers to align job titles, duties, and documentation precisely.

Director and Commissioner Positions

Indonesia allows foreign nationals to serve as directors and commissioners at the board level, provided their roles remain strategic rather than operational. They must not exercise direct authority over human resources, employment decisions, or industrial relations.

This distinction allows foreign investors and multinational corporations to appoint experienced executives to leadership and governance roles, while preserving Indonesian oversight over day-to-day workforce management and employment compliance.

Also read: Work Permit Requirements to Employ Expatriates in Indonesia

Positions Strictly Prohibited for Foreign Workers

Indonesia allows foreign workers in technical and strategic roles, but draws a clear line when it comes to workforce governance. The government reserves certain positions exclusively for Indonesian citizens to maintain local control over employment, labor relations, and human capital development.

Indonesia strictly prohibits foreign workers from occupying 18 positions, all of which sit within core human resources and employment administration functions:

- Personnel Director and Human Resource Manager

- Industrial Relations Manager and Personnel Development Supervisor

- Personnel Recruitment Supervisor and Personnel Placement Supervisor

- Employee Career Development Administrator and Personnel Declare Administrator

- Personnel Specialist and Personnel and Careers Specialist

- Career Advisor and Job Advisor

- Job Interviewer and Job Analyst

- Employee Mediator and Occupational Safety Specialist

- Job Training Administrator

The rationale is straightforward. Foreign workers may not hold roles that place them in control of hiring, termination, compensation, training, or industrial relations involving Indonesian employees. The government treats these functions as central to domestic labor governance and therefore reserves them as protected roles.

The RPTKA: Your Foundation for Hiring Foreign Workers

At the core of Indonesia’s foreign employment regime sits one non-negotiable document: the RPTKA or foreign manpower utilization plan.

The RPTKA is not an administrative formality. The government relies on the RPTKA as the primary gatekeeper for foreign employment. Without an approved RPTKA, employers cannot apply for work visas, and foreign nationals cannot legally commence employment, regardless of seniority, expertise, or urgency.

In regulatory practice, the RPTKA functions as both a justification and a commitment. Employers must explain why foreign expertise is genuinely required while simultaneously committing to how that expertise will be transferred to Indonesian workers over time.

What an RPTKA Must Cover

A compliant RPTKA goes far beyond listing a job title. It presents a structured compliance case that links business necessity, regulatory eligibility, and workforce development. At a minimum, the RPTKA must cover:

Company information — Legal entity details, business registration (NIB), tax identification, sector classification, and operational locations in Indonesia.

Position details — The proposed job title, scope of duties, required qualifications, and a clear explanation of why the role cannot reasonably be filled by an Indonesian professional.

Foreign worker data — The number of expatriates to be hired, their identities (if already determined), nationalities, contract duration, and indicative salary range.

Indonesian counterpart assignment — The names and positions of local employees designated to work alongside or be trained by the foreign worker.

Training and knowledge transfer plan — Concrete programs, timelines, and measurable outcomes demonstrating how skills, technology, or managerial expertise will be transferred to Indonesian staff.

In practice, the Ministry of Manpower assesses not only completeness, but internal consistency. Misalignment between job titles, actual duties, or training commitments remains one of the most common causes of delay or rejection.

The RPTKA Application Process

RPTKA applications are submitted electronically through the Ministry of Manpower’s TKA Online System. Once filed, the application enters the formal feasibility assessment stage.

During this review, officials assess whether:

- the proposed role is eligible under sector and position regulations,

- the use of foreign expertise is substantively justified, and

- the knowledge transfer plan is credible and measurable.

For complete and internally consistent submissions, the ministry typically issues its feasibility assessment within two business days.

Following a positive assessment, the employer proceeds to request RPTKA approval. This approval formally authorizes the employment of the foreign worker and specifies the individual’s name, position, employment duration, and assigned Indonesian counterpart.

Special RPTKA Exemptions

Recognizing the need for flexibility in specific contexts, the government has introduced limited exemptions and accelerated pathways under Government Regulation No. 34/2021.

Key exemptions include:

- Tech-based startups

- Vocational training and emergency activities

- Board members and shareholders

- Foreign government representatives and staff of international organizations.

Also read: Employment Types in Indonesia: Contracts and Regulations

DKPTKA: The Foreign Worker Compensation Fund

Once an RPTKA is approved, employers must satisfy the next mandatory obligation: payment of the DKPTKA.

DKPTKA is not a tax and not a penalty. It is a statutory compensation fund imposed on employers that utilize foreign labor, designed to support Indonesia’s workforce development, training, and skill-upgrading programs. In regulatory terms, DKPTKA payment is a hard gate — without it, work authorization cannot be finalized and immigration processing cannot proceed.

How DKPTKA Works in Practice

The contribution is fixed at USD 100 per foreign worker per month. Payment must be made upfront for the entire approved employment period, directly to a designated government or appointed bank account. The obligation is calculated based on the duration approved in the RPTKA, not on actual time worked.

For example, a two-year employment approval for a single expatriate requires a one-time upfront payment of USD 2,400 (24 months × USD 100).

If employment ends before the approved period, employers may apply for a refund of the unused portion. In practice, however, refund processing is administrative and document-heavy, often taking several months and requiring proof of early termination and immigration deregistration.

Only after DKPTKA payment is confirmed does the Ministry of Manpower issue the final RPTKA approval and transmit the employment data to immigration authorities, enabling the visa and stay permit process to begin.

DKPTKA Exemptions

Limited exemptions apply under Indonesian law. DKPTKA is not required for:

- Government institutions and public agencies

- Foreign diplomatic representatives and staff of international organizations

- Certain educational institutions and religious organizations

For all other private-sector employers, DKPTKA payment is mandatory and non-negotiable.

Immigration and Work Visa Requirements

Once RPTKA approval and DKPTKA payment are completed, compliance shifts from manpower regulation to immigration control. From this point forward, labor authorization and immigration status are legally linked — any inconsistency can invalidate the employment arrangement.

Step 1: Limited Stay Visa (VITAS)

The employer or foreign worker applies for a Limited Stay Visa (VITAS) through an Indonesian embassy or consulate abroad. Required documents include a passport valid for at least 18 months, RPTKA approval, DKPTKA payment proof, and an employment contract or appointment letter. Processing typically takes around five working days if documents are complete.

Step 2: Entry into Indonesia

Once issued, the VITAS allows the foreign worker to enter Indonesia for employment purposes.

Step 3: VITAS Conversion to KITAS/ITAS

After arrival, the foreign worker must convert the VITAS into an ITAS (KITAS) within 30 days at the local immigration office. The process includes biometric registration, an interview, and address verification. Approval generally takes about 14 working days.

Once issued, the KITAS/E23 serves as both the legal stay permit and work authorization.

Multiple Exit–Re-entry Permit (MERP)

Alongside the KITAS, the foreign worker receives a MERP, allowing multiple exits and re-entries during the permit’s validity without cancelling work or stay authorization.

Also read: How KITAS Holder Can Legally Work in Indonesia?

Ongoing Employer Obligations

Hiring foreign workers in Indonesia does not end with visa approval. Minister of Manpower Regulation No. 8/2021 imposes continuous compliance obligations for the entire employment period, reflecting Indonesia’s policy that foreign expertise must build local capacity, not replace it.

Knowledge Transfer and Localization

All foreign workers must be paired with an Indonesian counterpart to facilitate mandatory knowledge transfer. You are expected to implement structured training or mentoring programs that enable local employees to absorb technical, managerial, or strategic expertise. Foreign workers must also receive Bahasa Indonesia language training to support integration and workplace effectiveness.

These requirements are actively monitored. During inspections or RPTKA renewals, the Ministry of Manpower assesses whether knowledge transfer is substantive or merely formalistic — lack of documentation is a common enforcement risk.

Documentation and Permit Control

Regulation No 8/2021 places strong emphasis on documentation discipline. You must maintain complete and up-to-date records for each foreign worker, including RPTKA approvals, KITAS/ITAS, DKPTKA payment proof, employment contracts, and training records. Authorities may conduct inspections without prior notice, and documentation gaps — rather than visa violations — often trigger administrative sanctions.

Social Security and Insurance

If you employ foreign workers for more than six months, you must enroll them in BPJS Ketenagakerjaan or provide an approved equivalent insurance scheme. You are responsible for registration and contributions, which must comply with Indonesian payroll and wage regulations.

Also read: How to Register Employee with BPJS Ketenagakerjaan

Expatriate Payroll Tax

Once you legally hire an expatriate, you must shift your compliance focus from permits to payroll and taxation. In practice, errors in expatriate payroll tax Indonesia are among the most frequent audit findings — and they accumulate silently month by month.

Tax Residency: The 183-Day Rule

A foreign worker becomes an Indonesian domestic tax subject if they stay in Indonesia for more than 183 days within any rolling 12-month period or establish residence or center their economic interests in Indonesia.

The days do not need to be consecutive. Repeated short visits can unintentionally trigger tax residency, immediately changing withholding obligations and exposing employers to underpayment risk.

Income Tax Withholding (PPh 21 vs PPh 26)

Once residency is determined, employers must apply the correct regime:

- PPh 21 (domestic tax subject): progressive rates

- PPh 26 (non-resident): 20% flat tax

Withholding applies not only to salary, but also to allowances, bonuses, and certain benefits, which are common in expatriate compensation packages.

Payroll Administration and Reporting

You must withhold and report income tax monthly, issue annual withholding certificates, and maintain detailed payroll records for audits.

Managing expatriate payroll manually — especially alongside local employees — significantly increases the risk of errors. Different tax treatments, benefits, and residency status require consistent, system-based payroll administration to stay compliant.

Also read: Income Tax in Indonesia for Foreign Businesses

Sanctions and Compliance Risks

What if you violate recruitment of foreign workers regulation Indonesia? The regulation carries consequences that go well beyond fines.

Sanctions may include:

- administrative warnings and permit suspensions

- RPTKA revocation — employment termination and repatriation

- financial penalties including repatriation costs

- long-term bans on sponsoring foreign workers or operational suspension.

Common violations flagged during inspections include working without an approved RPTKA, role mismatches with the approved plan, missing Indonesian counterparts or knowledge-transfer records, and breaches of KITAS conditions — such as unauthorized duties or work locations.

One System to Manage Foreign Workers

Hiring foreign workers in Indonesia is not just about permits and visas. Once expatriates enter your organization, you must manage recruitment decisions, payroll accuracy, tax withholding (PPh 21/26), and ongoing compliance as interconnected risks.

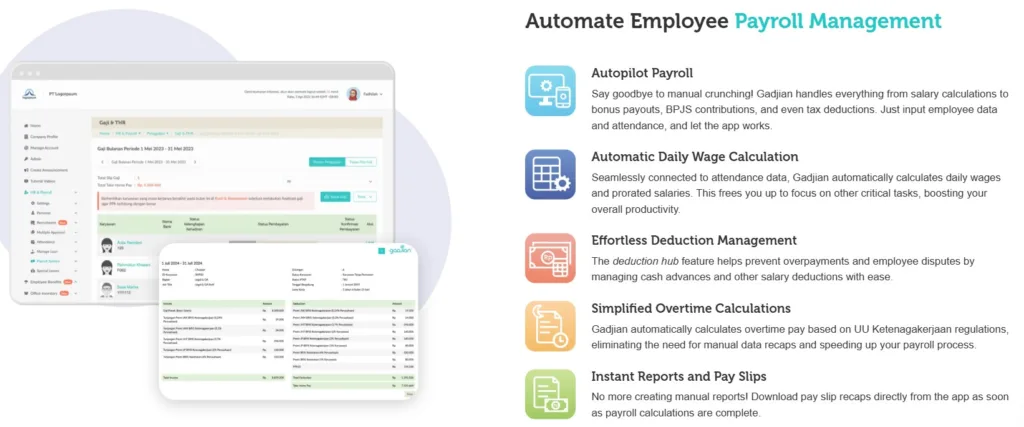

Gadjian is a cloud-based HRIS and payroll platform built specifically for the Indonesian regulatory environment — designed to help you manage foreign and local employees end-to-end, from recruitment to payroll and compliance monitoring.

With Gadjian, you can:

Recruit with structure and traceability

Gadjian’s recruitment module helps you manage job postings, applicant pipelines, interview stages, and hiring decisions in one system — creating a clear audit trail from hiring intent to employment contracts. This is especially valuable when recruiting foreign candidates for roles that must later align precisely with RPTKA-approved positions.

Automate payroll for expatriates and local staff

Gadjian web-based software calculates salaries, allowances, overtime, and deductions automatically, reducing manual errors — particularly for expatriates with complex compensation structures.

Apply accurate PPh 21 / PPh 26 withholding

The app’s built-in tax engine supports both domestic and non-resident tax subjects, generates correction-ready calculations, and produces outputs for tax reporting — supporting expatriate payroll tax Indonesia compliance.

Manage BPJS contributions

This SaaS calculates BPJS Ketenagakerjaan automatically and transparently as reflected clearly on payslips.

Integrate attendance directly into payroll

Attendance, leave, shifts, daily wages, and overtime flow seamlessly into payroll calculations — minimizing disputes and reconciliation issues.

Centralize employee and compliance records

Gadjian stores contracts, payroll history, tax data, and employment records in one system — keeping you audit-ready during inspections or tax reviews.

Operate across multiple entities and NPWPs

Ideal for companies employing foreign workers across different legal entities, projects, or locations.

HR Analytics dashboard

Gadjian’s AI-powered HR analytics dashboard provides real-time insights into workforce composition, payroll cost distribution, and productivity. These insights help you identify potential risks early.

Let Gadjian take care of your payroll and administration tasks so you can focus on growing your business in Indonesia. Start your free trial and see how Gadjian makes HR administration, operations, and employee management more efficient, compliant, and cost-effective.