Labor Law Regulations

Two labor law regulations apply in Indonesia today, Law No. 13 Year 2003 on Manpower and Law No. 6 Year 2023 on the Stipulation of Perppu on Job Creation Law (UU Cipta Kerja), also known as the Omnibus Law into Law, or also called the Job Creation Law 2023.

Basically, the latest Job Creation Law Chapter IV on Manpower is a revision of Law No 13 Year 2003, but not entirely. Thus, articles in Law No. 13 of 2003 that are not mentioned in Law No. 6 of 2023 still apply.

Based on this legal umbrella, the government implemented regulations for the Law, from Government Regulations to Ministerial Regulations.

A. Salary Guide in IndonesiaWage regulations are listed in Law No. 6 of 2023, Chapter IV Article 81 Number 27, concerning amendments to Article 88 of Law No. 13 of 2003.

The main rule in the latest Manpower Law is that every worker has the right to a livelihood that is decent for humanity, so the central government has established a wage policy as one of the efforts to realize the rights of workers. The wage policy in question includes:

- Minimum wage;

- Salary structure & scale;

- Overtime pay;

- Absence and off work pay;

- Wage form and method;

- Things depend on wage;

- The wage for calculating other payments.

The main points of the regulation are outlined in more detail in Government Regulation No. 36 of 2021 concerning Wages, which is the implementing regulation of the Job Creation Law.

1. Mininum Wage

Every employer is prohibited from paying employees wages below the applicable minimum wage. The minimum wage is the lowest standard in Indonesia's wage system, and only applies to employees with less than 1 year of service.

Meanwhile, the wages of employees with a work period of 1 year or more are guided by the structure and scale of salary.

The latest minimum wage rules are contained in Government Regulation No. 51 of 2023 concerning Amendments to the Wage Regulation. There are two types of minimum wages, provincial minimum wages (UMP) and district/city minimum wages (UMK).

Minimum wage adjustments are made annually by the governor using a minimum wage calculation formula by considering economic growth variables, inflation, and certain indices. The formula is:

UM (t) is the current year's minimum wage, UM (t+1) is next year's minimum wage, PE is economic growth, and α is an index of labor contribution to regional economic growth, ranging from 0.10 to 0.30.

UMP is determined every November 21 and UMK every November 30. The minimum wage applies in each region starting January 1 of the following year.

Minimum wage provisions are exempted for micro and small businesses, where workers' wages are determined by agreement, provided that they are at least 50% of the average consumption of people in the province or 25% above the poverty line in the province.

2. Salary Structure & Salary Scale

Salary structure & salary scale are the arrangement of wage levels from the lowest to the highest or vice versa, which contains the nominal range of wages from the smallest to the largest for each position class. Meanwhile, position class is a grouping of positions based on the value or weight of the position.

According to Law No. 6 of 2023, Article 81 Point 33, each businessman is obliged to prepare a salary structure and scale by taking into account the company's ability and productivity.

The salary structure and scale are used as guidelines for employers in determining workers' wages, and must be notified to each worker individually.

Provisions and ways to compile salary structures and scales can be seen in the Wage Government Regulation and Minister of Manpower Regulation No. 1 of 2017 concerning Wage Structures and Scales.

Learn how to structure and scale of salary!

3. Overtime Pay

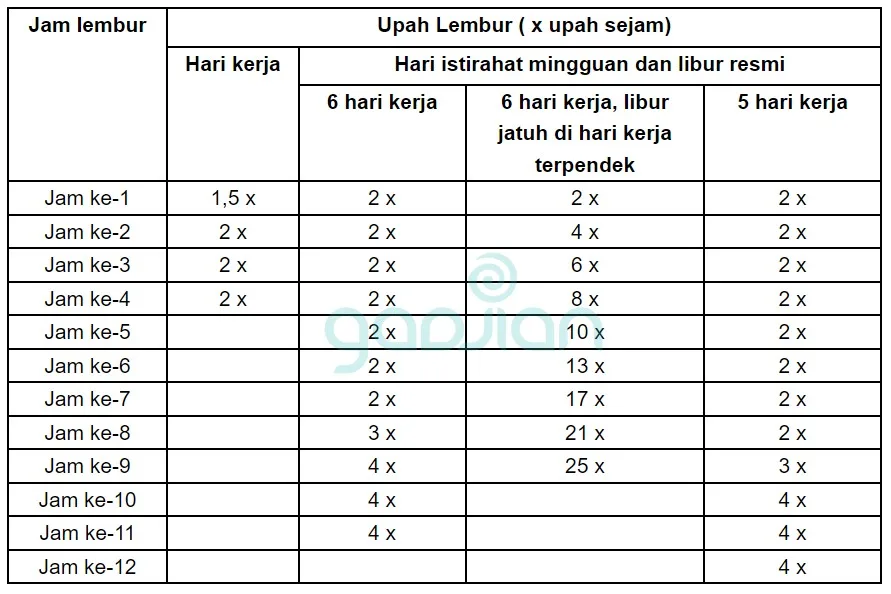

Overtime work pay is calculated using an hourly wage based on a month's wage. The hourly wage is 1/173 times a month's wage (basic salary and fixed allowances).

The provisions of hourly overtime pay are regulated in Government Regulation No. 35 of 2021. Here is the formula in the table:

Understand the latest overtime calculation example!

4. Absence and Off Work Pay

The Labor Law stipulates that wages are not paid if employees do not work. However, if the employee does not come to work for the following reasons, then the employer is still obliged to pay the wages:

- sick workers / laborers so they cannot do work;

- women who are sick on the first and second day of their menstrual period so they cannot do work;

- workers do not enter work because they are marry, marry off, circumcise, baptize their children, give birth or miscarriage wives, husbands or wives or children or daughter-in-law or parents or in-laws or family members in one house die;

- workers / laborers cannot do their jobs because they are carrying out obligations towards the state;

- workers / laborers cannot do their work because they carry out worship that is ordered by their religion;

- workers / laborers are willing to do the work that has been promised but the employer does not employ him, either because of his own mistakes or obstacles that employers should be able to avoid;

- workers carry out the right to rest;

- workers carry out the duties of trade unions / labor unions with the agreement of employers; and

- workers carry out educational tasks from the company.

An employment contract or work agreement is an agreement between workers and employers orally and/or in writing, either for a certain time or an indefinite time, which contains working conditions as well as the rights and obligations of workers and companies.

Through the employment contract, the status of the employment relationship between employees and employers can be determined.

Law No. 6 of 2023 Article 81 Numbers 12 to 16 explains the types of employment contracts and the status of employment relationships, namely:

1. Fixed-Term Employment Agreement (PKWT)

PKWT is a written work agreement between employees and employers to establish a working relationship for a certain period or for a certain job.

The maximum term of PKWT is 5 years, including contract extensions, and there is no probation period. PKWT employees have the status of contract employees.

The employment relationship ends at the completion of the contract period or the completion of the agreed work. When the employment relationship ends, employers are obliged to pay PKWT compensation to contract employees, the calculation of which is regulated in Government Regulation No. 35 of 2021.

Non-permanent contracts cannot be made for permanent and continuous work, but only for temporary, one-off, or seasonal work. The types of non-permanent contracts and the rules for contract employees can be found in the Government Regulation.

See examples and how to write an employment contract!

2. Permanent Employment Agreement (PKWTT)

PKWTT is a work agreement between employees and employers to establish an employment relationship that is not limited in time for permanent and continuous work. PKWTT employees have the status of permanent employees.

In permanent contracts, employers may require a probationary period of work with a maximum period of 3 months. If the trial work period is longer than 3 months, the employee's status automatically changes to permanent employee in the 4th month.

PKWTT work relations can only end through termination of employment, either by the employer or the employee. In the event of termination of employment, employers are obliged to pay severance pay, reward pay (for working period), separation pay, and compensation pay, which are regulated by law.

Check the list of the Job Creation Law question and answer about employment agreements!

3. Daily Work Agreement

Daily work agreements are regulated in Government Regulation No. 35 of 2021, Article 10, which stipulates that non-permanent contracts are made for certain jobs whose type and nature or activities are not fixed, changing in terms of time and volume of work, and payment of workers' wages is based on attendance. The status of workers is daily workers.

This agreement must fulfill the conditions, i.e. the number of working days is less than 21 days in a month. If the working days are 21 days or more in a month for 3 consecutive months, the employment relationship changes to PKWTT and the worker's status becomes a permanent employee.

4. Outsourcing Agreement

Outsourcing is the transfer of some work to another company. An outsourcing agreement is a written contract entered into by an employer with a company that provides outsourced workers, based on the need to use labor for a certain time.

Outsourced workers are employees of the outsourcing company that recruits them, not employees of the user company, so their rights, welfare, and wage payments are the responsibility of the outsourcing company.

In addition to Law No. 6 of 2023, provisions regarding outsourcing are also regulated in Government Regulation No. 35 of 2021.

Here's an example of an outsourcing agreement!

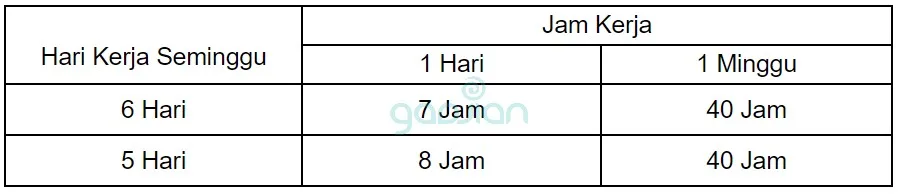

C. Working Time and Working BreakEach company can have its own rules for working hours or working days, but the amount of working time must comply with the law. Working time is set by the government in Law No. 6 of 2023 Article 81 Number 23.

The above working time provisions do not apply to certain regulated business sectors or occupations.

1. Working Hours and Overtime Hours

Working hours according to the latest labor regulations are divided into 4 types, i.e:

- Fixed working hours

- Part-time working hours

- Flexible working hours

- Shift work hours

Working hours are the time to do work, which can be during the day and/or night. Companies can make work schedules and rules for the start and end of working hours according to company needs, which are regulated in work agreements, company regulations, or collective labor agreements.

If employers want employees to work beyond working hours, then according to Article 81 Number 24, they must fulfill two conditions, which are obtaining employee approval and counting it as overtime work and paying overtime wages according to government regulations.

The latest overtime regulation in Law No. 6 of 2023 states that the maximum number of overtime working hours in private companies is 4 hours a day and 18 hours a week. The amount does not include overtime during weekly breaks or Indonesian public holidays.

Here are the latest working hour rules for companies!

2. Rest Period and Annual Leave

The provision of rest period is regulated in Article 81 Number 25 which states that employers are obliged to provide rest time and leave. Rest time is given between working hours, at least half an hour after the employee has worked 4 hours continuously, and is not counted as working time. In addition, employees are also entitled to weekly rest at least 1 day a week.

Read questions and answers about work breaks!

Meanwhile, annual leave is an employee's right to rest that must be given at least 12 working days after the employee has worked for 12 months continuously.

The implementation of annual leave is regulated in a work agreement, company regulation, or collective labor agreement.

While exercising the right to rest and leave, the employee concerned is still entitled to full wages.

See and learn the types and rights of employee leave according to the latest law.

The right to rest or leave must also be given to employees for the following reasons:

- Childbirth or miscarriage;

- Illness and unable to work;

- Leave or permission for important reasons, which is regulated in Article 93 paragraph (2) of Labor Law No. 13 Year 2003.

3. Sick Leave

If employees are unable to perform their work due to illness, employers are still obliged to pay their wages. However, employees who are sick and absent from work for 2 consecutive days or more must provide a sick note from a doctor. Otherwise, the employee is considered absent and may reduce the annual leave allowance.

If the illness suffered by the employee is quite severe, for example, due to a work accident or occupational disease that requires an uncertain recovery time, the employer adjusts the wages, with the provisions of 100% for the first 4 months, 75% for the second 4 months, 50% for the third 4 months, 25% for the next month, and the employer may lay off.

The Labor Law provides a sick leave limit of up to 12 months. If this time limit has not been exceeded, employers may not lay off workers due to illness.

D. Termination of Employment (Layoff)Termination of employment (PHK) is the termination of employment relations due to a certain reason that results in the end of rights and obligations between employers and employees.

Layoffs cannot be carried out unilaterally by employers, but must go through a mechanism by the law.

1. Layoff Mechanism

Layoffs can only be carried out for 15 types of reasons mentioned in Law No. 6 of 2023 Article 81 Point 45. Conversely, employers are also not allowed to lay off for 10 types of reasons stipulated in Article 81 Point 43.

The layoff procedure begins with the submission of a layoff notification letter along with the reasons from the employer. If the employee does not refuse and does not object to the layoff notification letter, then the layoff is simply registered with the local Manpower Office and the employer pays the layoff compensation following the provisions of the Law.

In the event that the employee objects to the layoff, then it is mandatory to make a rejection letter within 7 days after receiving the notification letter. The next process is bipartite negotiations, tripartite negotiations, and through industrial relations dispute settlement institutions.

Learn the layoff provisions according to the latest law in Indonesia!

2. Rights of terminated employees

Employers are obliged to pay the rights of terminated employees in the form of severance pay, reward pay for working period (UPMK), separation pay, and compensation pay. How to calculate severance pay and UPMK is regulated in Government Regulation No. 35 of 2021.

Not all terminated employees get the same rights, but it depends on the type of reason for termination. For example, in the case of termination because the employee is absent, or commits a criminal offense, or resigns on his own accord, then they are not entitled to severance pay and UPMK, but only given separation pay and compensation pay.

Here is the latest severance pay calculation!

Labour Regulation

Labour Regulation  Payroll

Payroll  Social Security

Social Security